Chartered accountants work in all fields of business and finance including audit, taxation, financial and general management. Some are engaged in public practice work, others work in the private sector and some are employed by government bodies. Chartered accountants' institute requires its members to undertake a minimum level of continuing professional development to stay professionally competitive. Under the Scheme of Education and Training, a candidate can pursue Chartered Accountancy Course either through, Foundation Course Route or Direct Entry Route.

Watch Video| Course | Eligibility |

|---|---|

| CA FOUNDATION | Class 10 + 2 |

| CA INTERMEDIATE | Graduates or CA FOUNDATION passed students |

| FINAL COURSE | CA INTERMEDIATE passed students |

Total Fees to be paid to ICAI for whole course comes to around INR Fifty thousand. If you join coaching classes, fees would be near about One lakh to two lakhs from CPT to Final.

Effective Communication Skills

Audit and Accounting

Analytical Skills

Technological skills

Commercial Knowledge

The Chartered Accountant exams or CA exams that a student has to give in order to receive the designation of a CA are given below. Only when the candidate has qualified all these exams is he/ she considered a Chartered Accountant and gets authenticated as the same. The exams of CA are:

CPT (Common Proficiency Test)

IPCC (Integrated Professional Competence Course)

FC (Final course)

Navkar Institute, Ahmedabad (https://www.navkarinstitute.com)

Navkar institute,Vapi

Aditiya Jhawar education,Surat

J.K.Shah Institute, Ahmedabad (https://www.jkshahclasses.com)

J.K.Shah Institute, Mumbai

Professional Academy, Mumbai

AT Academy, Mumbai (https://www.atacademy.co.in)

Agarwal classes, Pune (https://www.agrawalclasses.in)

Aldline CA, New Delhi

Academy of Commerce, New Delhi

Nahata Professional Academy, Indore

Yeshas Academy, Banglore

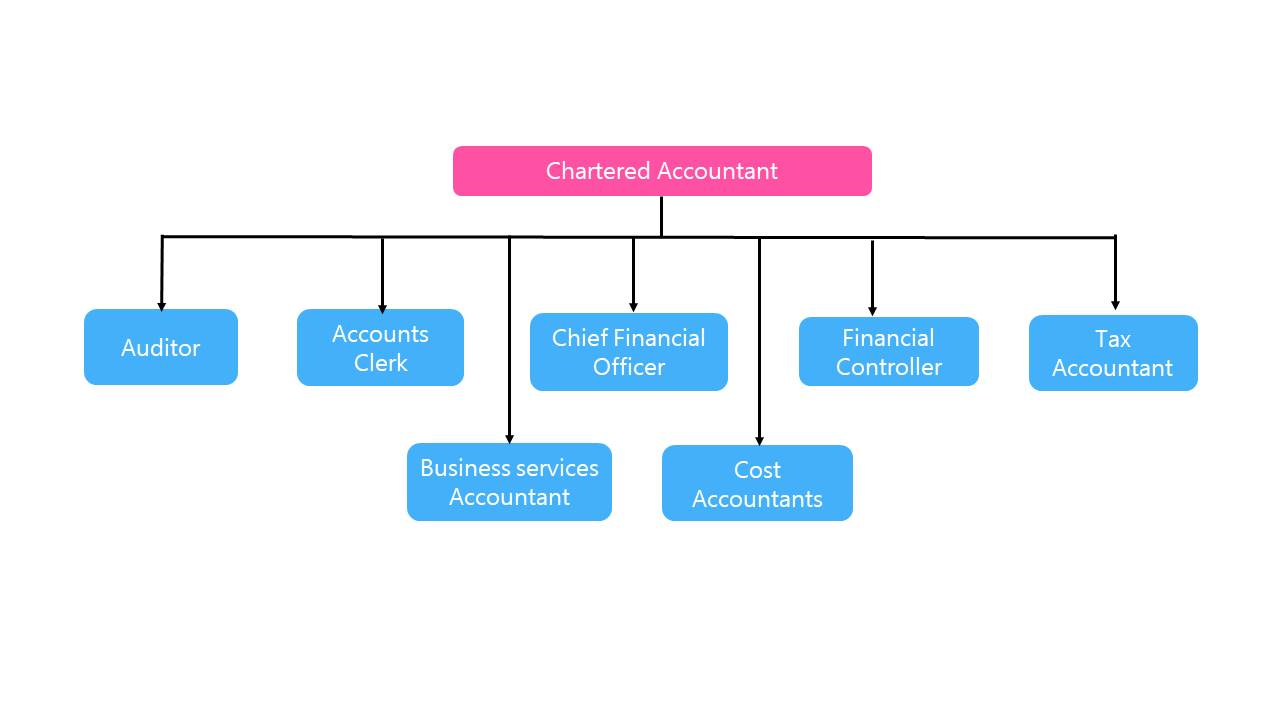

A qualified CA can get employment opportunities in following areas:

Public and Private Sector Banks

Public Limited Companies

Auditing Firms

Stock Broking Firms

Finance Companies

Investment Houses

Legal Firms

Patent Firms

Portfolio Management Companies

Note:

All the students, teachers and guardians should note that the above mentioned websites and information on various colleges / universities may change under the rules and regulations of the education department.